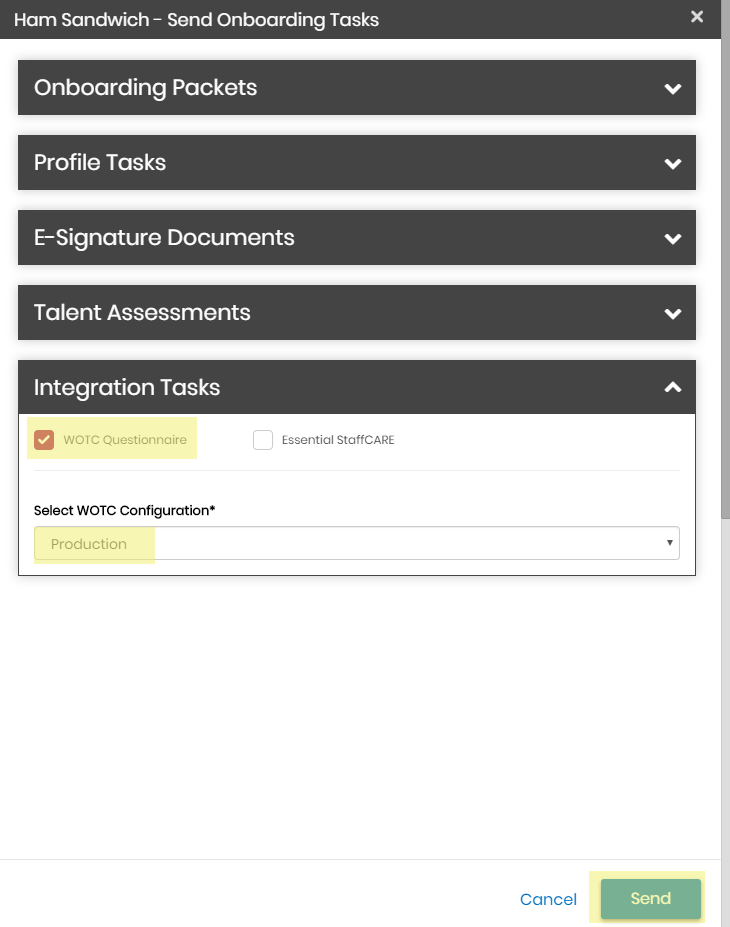

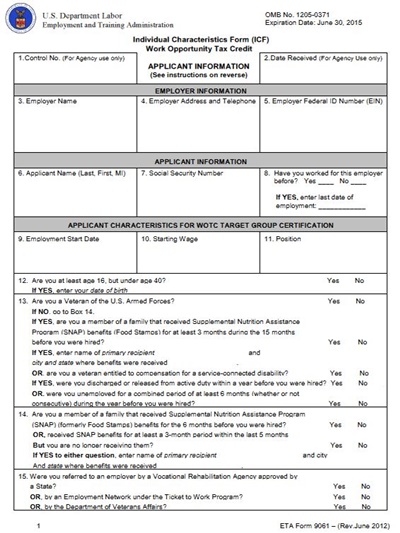

work opportunity tax credit questionnaire on job application

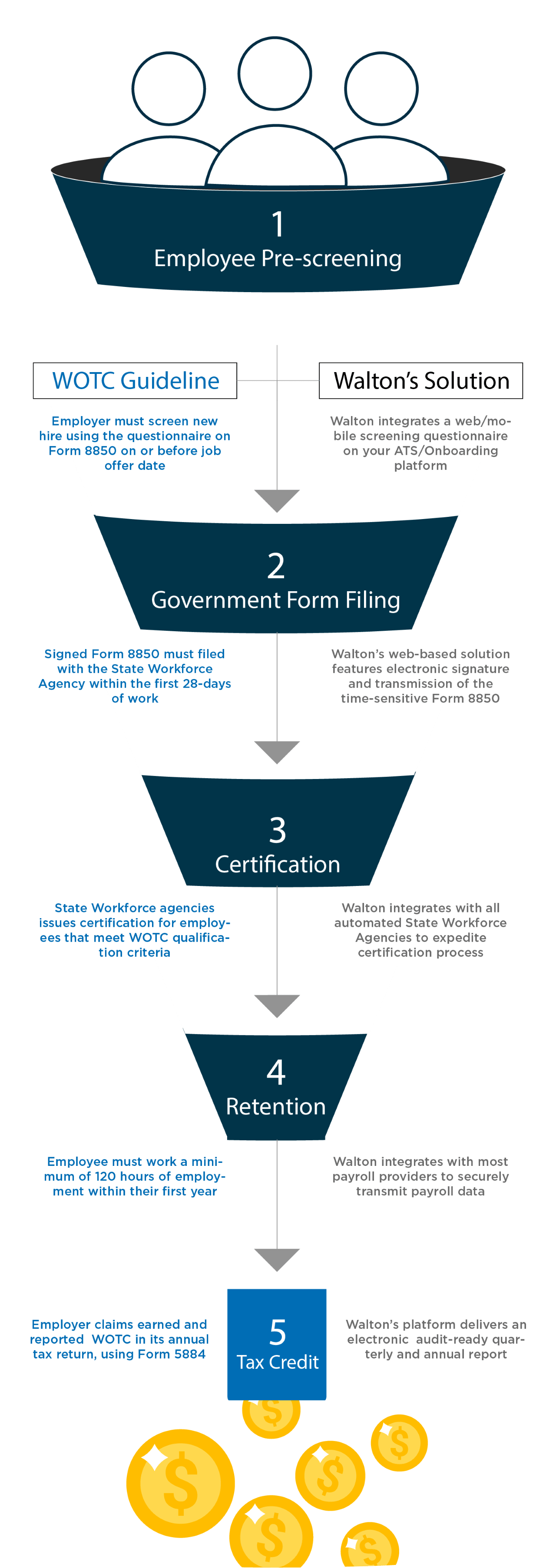

One year of experience refers to full-time work. The state tax credit application and certification process is a three-part process.

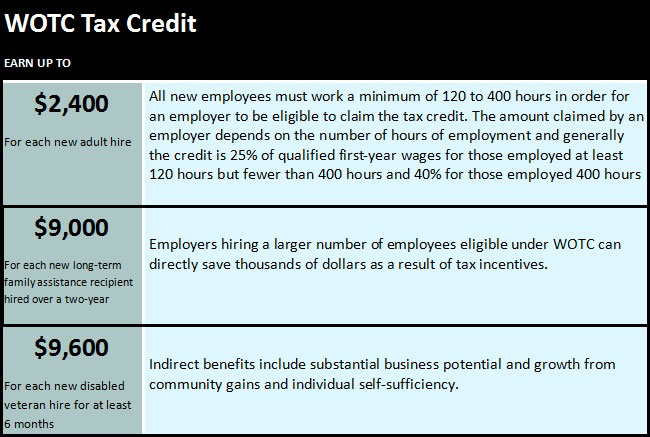

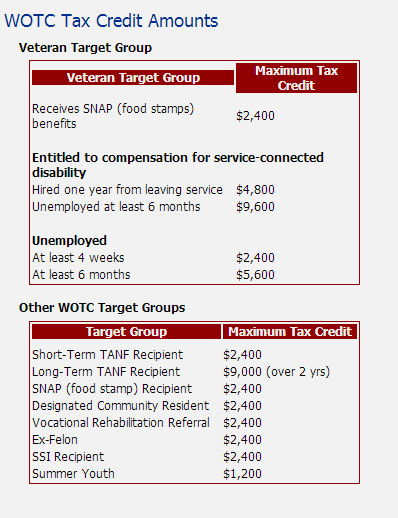

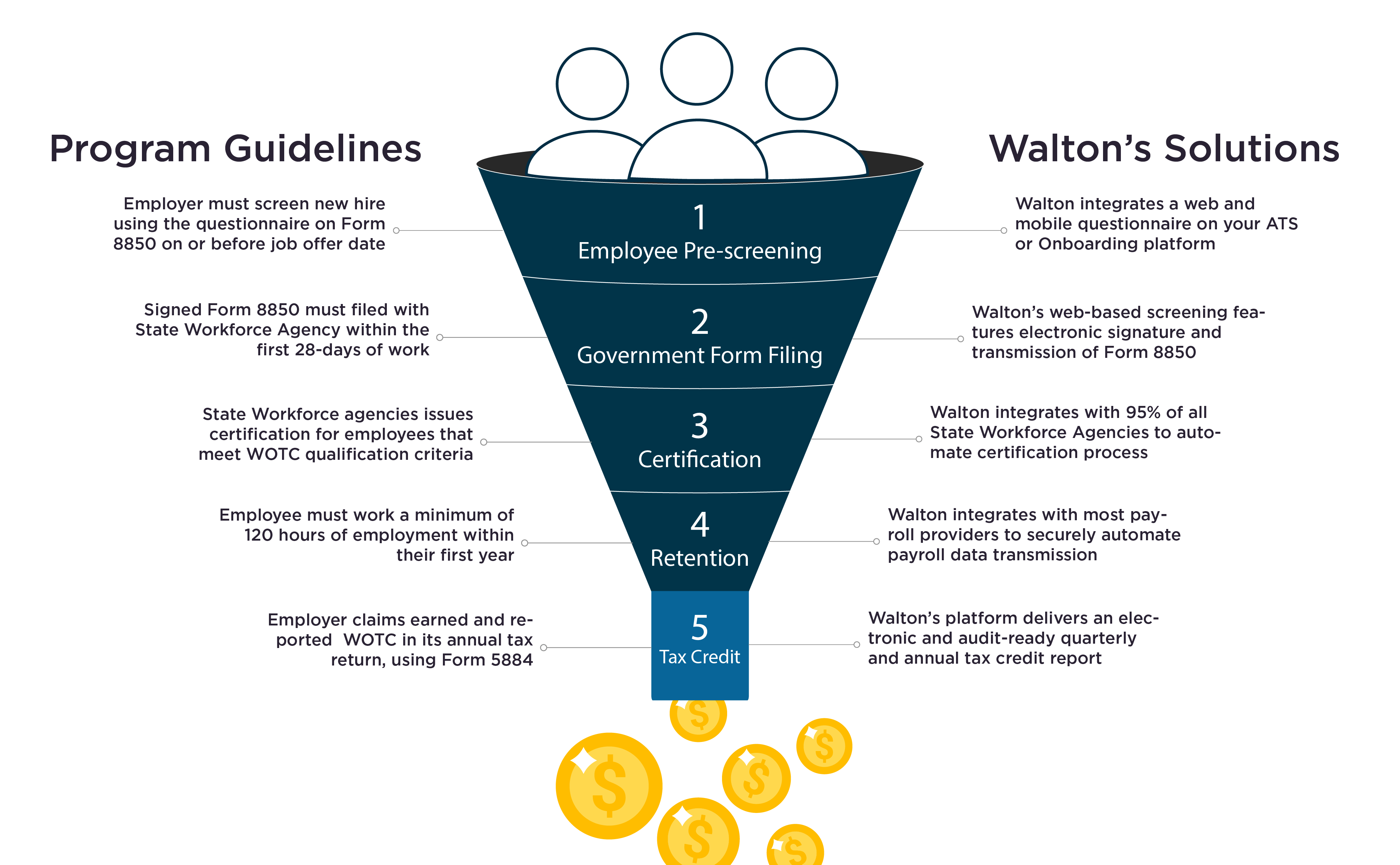

Work Opportunity Tax Credits Wotc Walton

Office of Chief Counsel IRS is looking for enthusiastic individuals to join our team and gain valuable experience in a legal environment.

. Our mission is to serve Americas taxpayers fairly and with integrity by providing correct and impartial interpretation of the internal revenue laws and the highest quality legal advice and representation for the IRS. For instance when a job applicant responds to a job posting we will share your personal data with the employer in order to facilitate the job search and hiring process. Architects.

Employment is a relationship between two parties regulating the provision of paid labour services. Work Opportunity Tax Credit Business or Consultant. You will need to file an application show that you meet the minimum qualifications as defined by the job announcement and then go through an examination process.

Audit and transform your Form I-9 compliance process. Scroll down and locate your job application. Keystone Opportunity Zone Tax Credit.

That is a potential of up to 5000 per employee. Create an Account for Montana Works. Part 1 certification that a property is a certified historic property.

In 2020 a credit is available up to 5000 per employee from 31220-123120 by an eligible employer. ERCT Compliance System 2012. The Relevant contracts tax compliance system has undergone a complete transformation.

Employees at the agency enjoy flexible work hours and several benefits that make their career a pleasant one. Instantly compare candidate-stated application data to verified employment data. To ensure full credit for your work experience please indicate dates of employment by monthyear and indicate number of hours worked per week on your resume.

Provisional Appointments When a department needs to fill a vacancy that is covered by the civil service process but no applicant pool of eligible employees is available departments. Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work. General information Reference 000099 Publication start date 03062021 Job description GAP one Post description Admin Assistant Vacancy details Division Head Office - GAP One Title Credit Control Admin Assistant - Glasgow Contract type Permanent Full Time Vacancy location Location Scotland Scotland Glasgow Location Glasgow G2 8DA Employment Details Contract hours.

The Equal Credit Opportunity Act ECOA is a federal law preventing lending discrimination based on factors unrelated to a persons ability to repay. This is a fillable application form that must be printed and mailed in. The Department of Revenue has created a short questionnaire to gather feedback from customers.

Employees work in return for wages which can be paid on the basis of an. It is a great place to work with an. If a background check reveals a criminal record the Fair Credit Reporting Act FCRA requires employers to undergo adverse action and give the candidate the opportunity to dispute the.

The CRA is a great organization to work for. Capture all of your available tax credits. Take the survey to help us serve you better.

The ERTC program is a refundable tax credit for business owners in 2020 and 2021. Work Opportunity Tax Credit Management. Changes the existing requirements under which the Colorado office of economic opportunity office uses a lottery process to determine the order in which it will review applications and.

The traditional collection of paper based forms completion of monthly and annual returns and even the familiar C2 card or C2 Authorisation has now been replaced by the new online eRCT compliance system with effect from 1 January 2012. Part-timework is considered on a prorated basis. If your current or former employer uses one of our Services personal data you input into those Services is accessible by that employers end users - subject to the security.

Use code enforcement numbers to request a payoff. Once the job has been located click. Resolve bills or liens for work done by the City on a property.

The CRA is a suitable place to work if you really care about work-life balance comfortable lifestyle and frequent pay checks. Job SeekerUI Claimant Work Opportunity Tax Credit Business or Consultant. Offer remote in-person I-9 verification with our nationwide network of authorized I-9 representatives.

Job Creation Tax Credit.

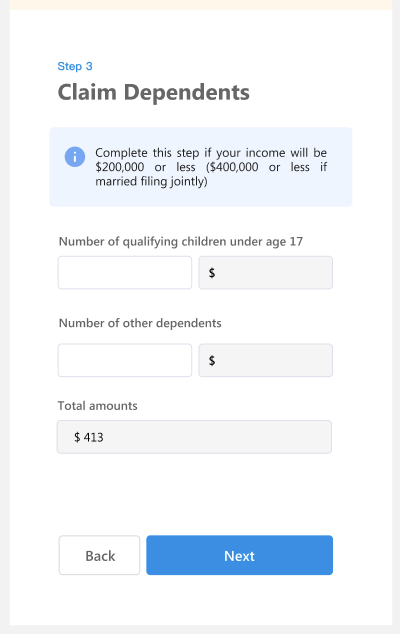

New W4 Form Wotc Screening Features Product Updates

Work Opportunity Tax Credit What Is Wotc Adp

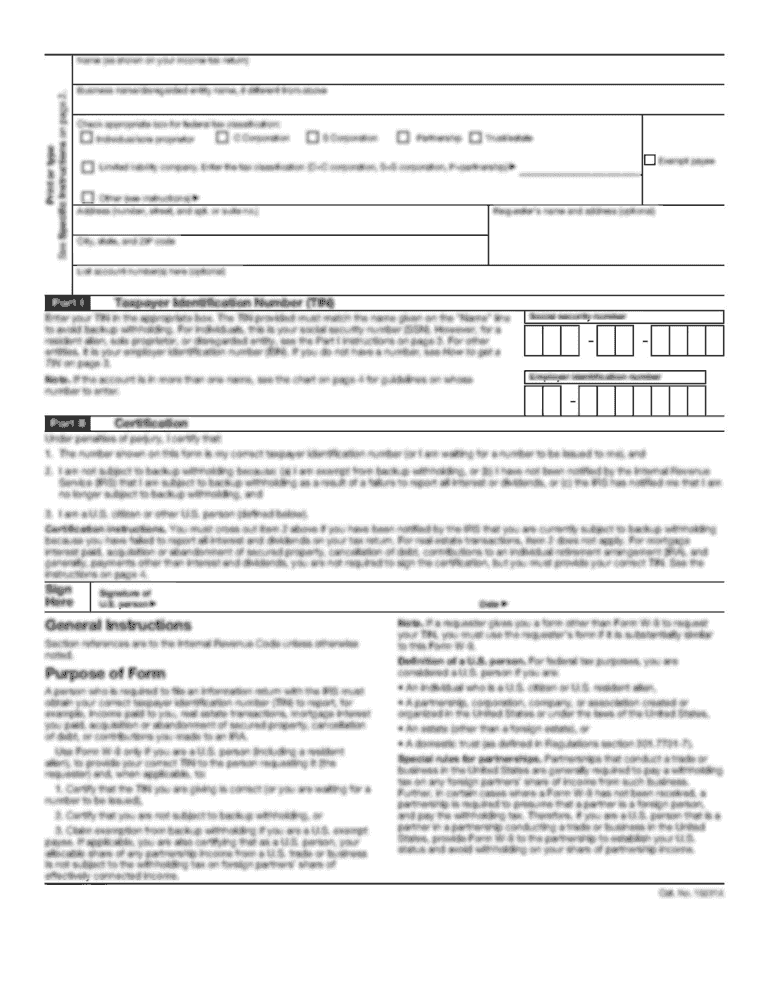

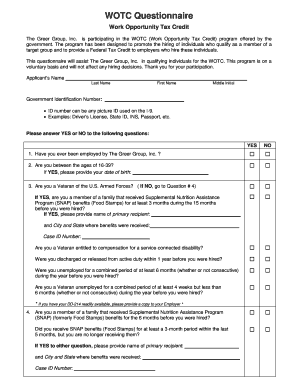

Wotc Questions What Is The Work Opportunity Tax Credit Questionnaire Cost Management Services Work Opportunity Tax Credits Experts

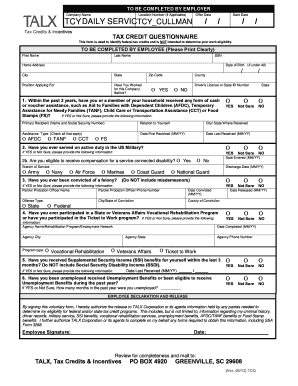

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

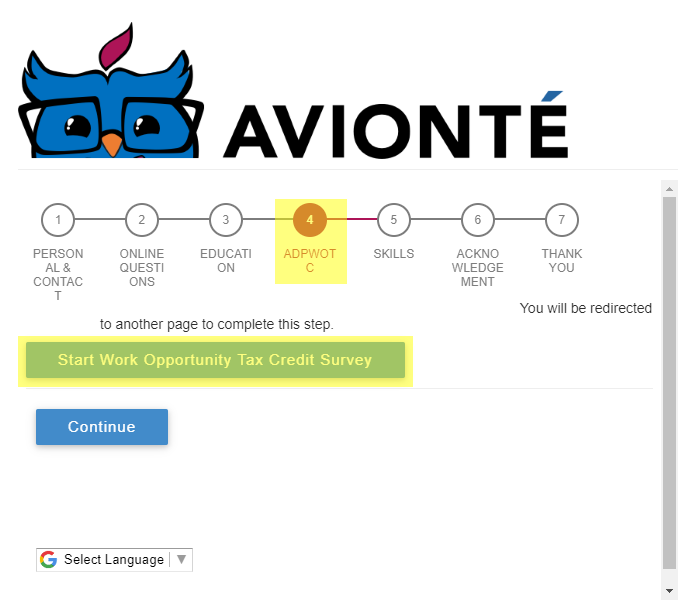

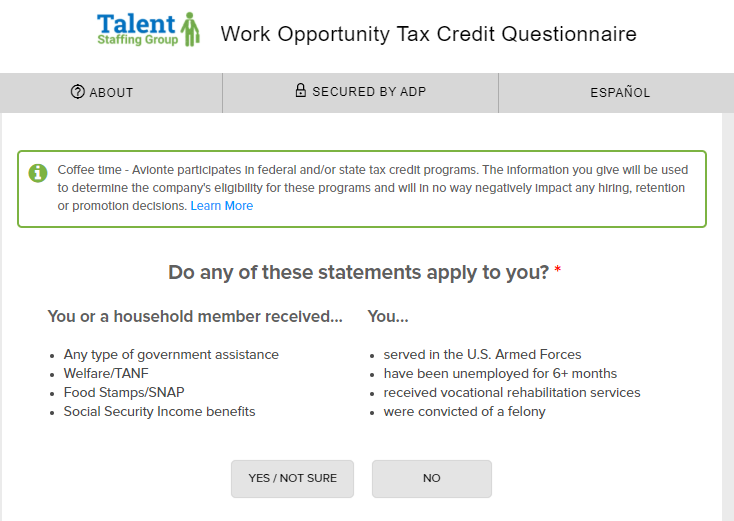

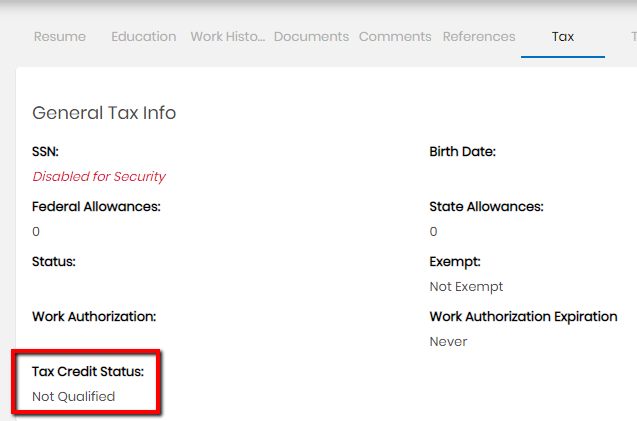

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

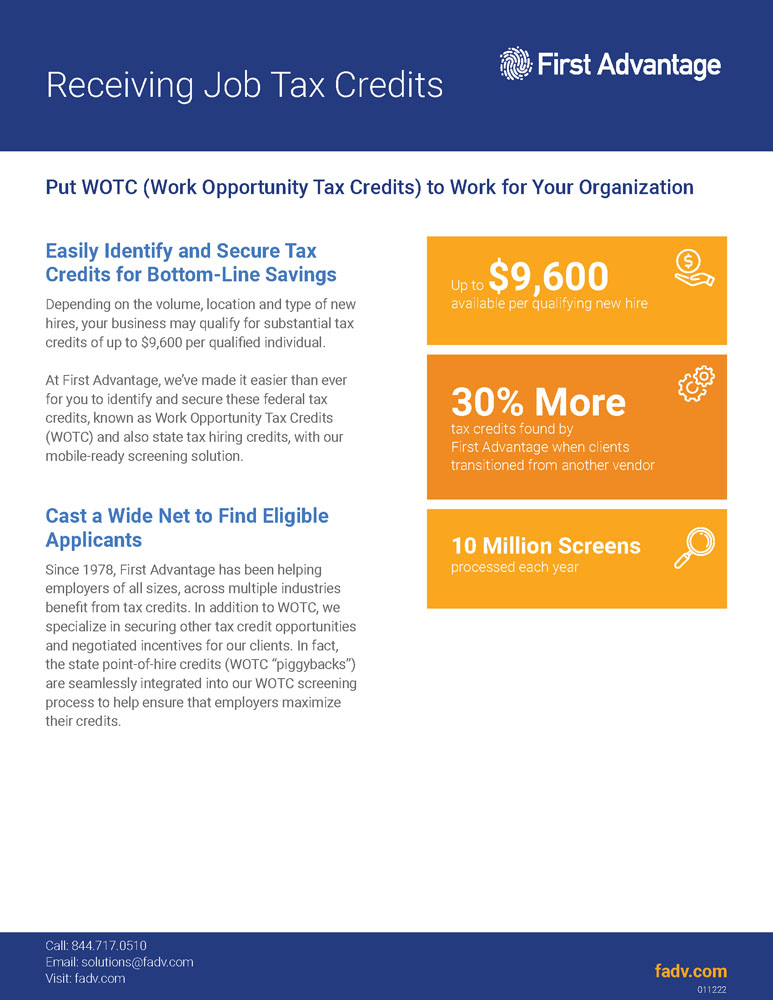

Work Opportunity Tax Credit First Advantage

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Completing Your Wotc Questionnaire

With Wotc Timing Is Everything Wotc Planet

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit Youtube